TGS AU Partners quick outing 2022 for healing and team building Friday, September 23, 2022, TGS AU Partners held a two-day outing with all employees to the Cikole area, Lembang, Bandung City. In addition to unwinding, this activity is also

You are on the page

Would you like to stay on this page or return to the Main Site?

Stay Here Go to HomepageBlog

TGS AU Partners served as speakers at the 2022 UTS BAcc Asia Leadership Intensive Program for Accounting students from the University of Technology Sydney. Mr. Mikail Jaman (also known as Mikail Jam'an), Managing Partner, outlined Indonesia's public accounting firm operations, financial reporting standards (SAK), and accounting profession landscape. Together with Mrs. Yuli (Tax Manager), Indonesian tax regulations were also discussed. The event featured an interactive Q&A session moderated by Mikail Jaman (Mikail Jam'an), including a deep dive into Indonesia's three SAK frameworks: General SAK, SAK ETAP, and SAK EMKM.

In this year's era, cooperation and collaboration is one way that can be done to encourage the achievement of goals more quickly and efficiently. Cooperation or collaboration is carried out as an effort to develop productivity between employees and organizations, obtain new ideas, and bring individuals or organizations together in a supportive atmosphere systematically to solve a problem that cannot be easily done by a group alone.

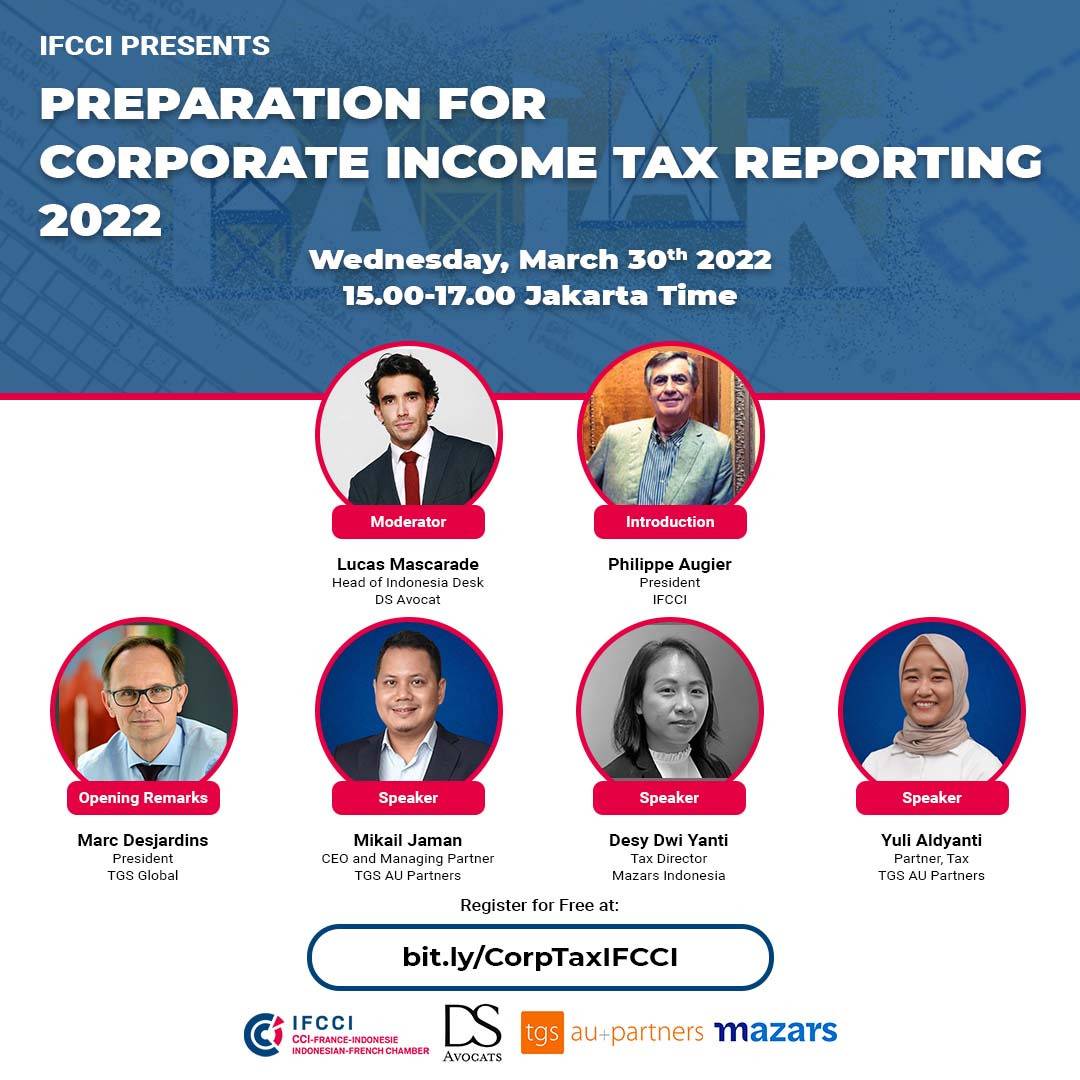

Ahead of the April 30, 2022 corporate tax filing deadline, TGS AU Partners is partnering with IFCCI to host the online webinar “Indonesia Corporate Income Tax 2021 Preparation, Important Points in CIT 2021” via Zoom on Wednesday, March 30, 2022, from 3:00–5:00 PM WIB. Featuring opening remarks by Philippe Augier and Marc Desjardins, moderated by Lucas Mascarade, and speakers Mikail Jaman (also known as Mikail Jam’an), Desy Dwi Yanti, and Yuli Aldyanti

The Voluntary Disclosure Program or the term often used, the 2022 Indonesia Tax Amnesty is a program that provides the following facilities or relief to taxpayers: