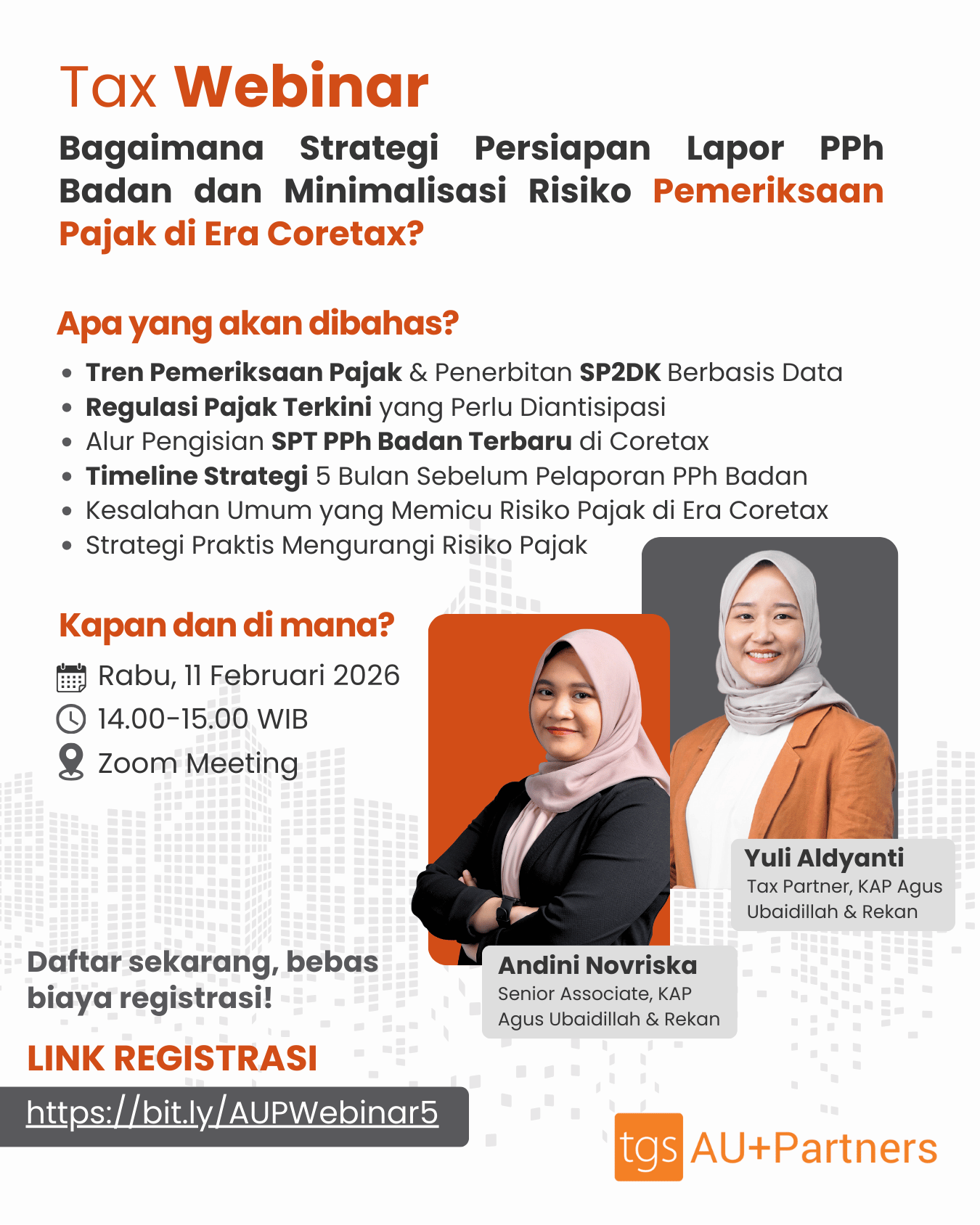

The implementation of the Coretax System by the Directorate General of Taxes (DGT) has fundamentally changed how corporate taxpayers are monitored. Even minor data inconsistencies can now trigger automatic system-based clarifications. TGS AU Partners provides integrated ... Read more

You are on the page

Would you like to stay on this page or return to the Main Site?

Stay Here Go to HomepageNews Category Tax

As the corporate tax filing season approaches, every financial and fiscal decision made by a company will be increasingly scrutinized—not only by tax auditors, but also by the Coretax system. This digital tax administration platform enables the tax authority to conduct ... Read more

Comparability analysis in transfer pricing is one of the pivotal aspects for implementing the arm's length principles in business. It is so crucial that it has its own regulations being outlined in the Directorate General of Taxes Regulation Number PER-32/PJ/2011 (Peraturan ... Read more

Lately, the implementation of the Principle of Recognizing Service Users (PMPJ) has been emphasized more in the service sector. This is because PMPJ has evolved into an essential foundation that needs to be applied to provide technical guidance. These principles can facilitate ... Read more

In order to support Anti Money Laundering/Terrorist Financing Prevention (Anti Pencucian Uang/Pencegahan Pendanaan Terorisme or APU/PPT) efforts, Accountants and Public Accountants are required to implement and adhere to the provisions regarding the Principles in Recognizing ... Read more

Under the changes in the Harmonization of Tax Regulations Law, there are three mechanisms for calculating Value Added Tax (VAT): the general mechanism, calculation based on other valuation bases, and VAT at certain amount. One of the regulations that discusses a certain amount ... Read more

Taxation is an aspect of a country's economic activities. For businesses, adhering to tax obligations is not only a legal responsibility but also an integral part of maintaining reputation and ensuring the continuity of operational activities. In this context, tax compliance ... Read more