Speaking of taxation, it seems to be an endless topic. There are many aspects to be discussed, and one of them is tax violations. When discussing violations in tax matters, there are two common types of violations that need to be known: tax fraud and tax evasion. These two terms ... Read more

You are on the page

Would you like to stay on this page or return to the Main Site?

Stay Here Go to HomepageNews Category Tax

Benefit in kind expense becomes a deductible expense but also becomes an object of income tax for its recipients with Law number 7 of 2021 regarding Harmonization of Tax Regulations which is regulated through Government Regulation number 55 of 2022, which is effective from 20 ... Read more

Tax Facilities in Indonesia The Indonesian government provides tax facilities in Indonesia for Indonesian limited liability companies including: Companies in certain pioneer business fields with a minimum investment starting from 500 billion rupiah Companies ... Read more

In this publication, KAP Agus Ubaidillah dan Rekan (TGS AU Partners) will only discuss some of the tax obligations for limited liability companies which we consider important in doing business in Indonesia. Income tax is imposed on income received by corporate taxpayers ... Read more

According to Government Regulation (GR) number 55 of 2022, income of up to 500 million rupiah received by certain taxpayers who are subject to final tax (businesses with turnover below 4.8 billion rupiah in 1 tax year and fulfill the requirements according to GR 55 of 2022), ... Read more

In previous articles, TGS AU Partners has informed several tax policies that are regulated in the HPP Law. Starting from tax rates and how to calculate PPh 21, the latest VAT provisions in the HPP Law, into a complete explanation of Tax Amnesty 2. As a follow-up to these ... Read more

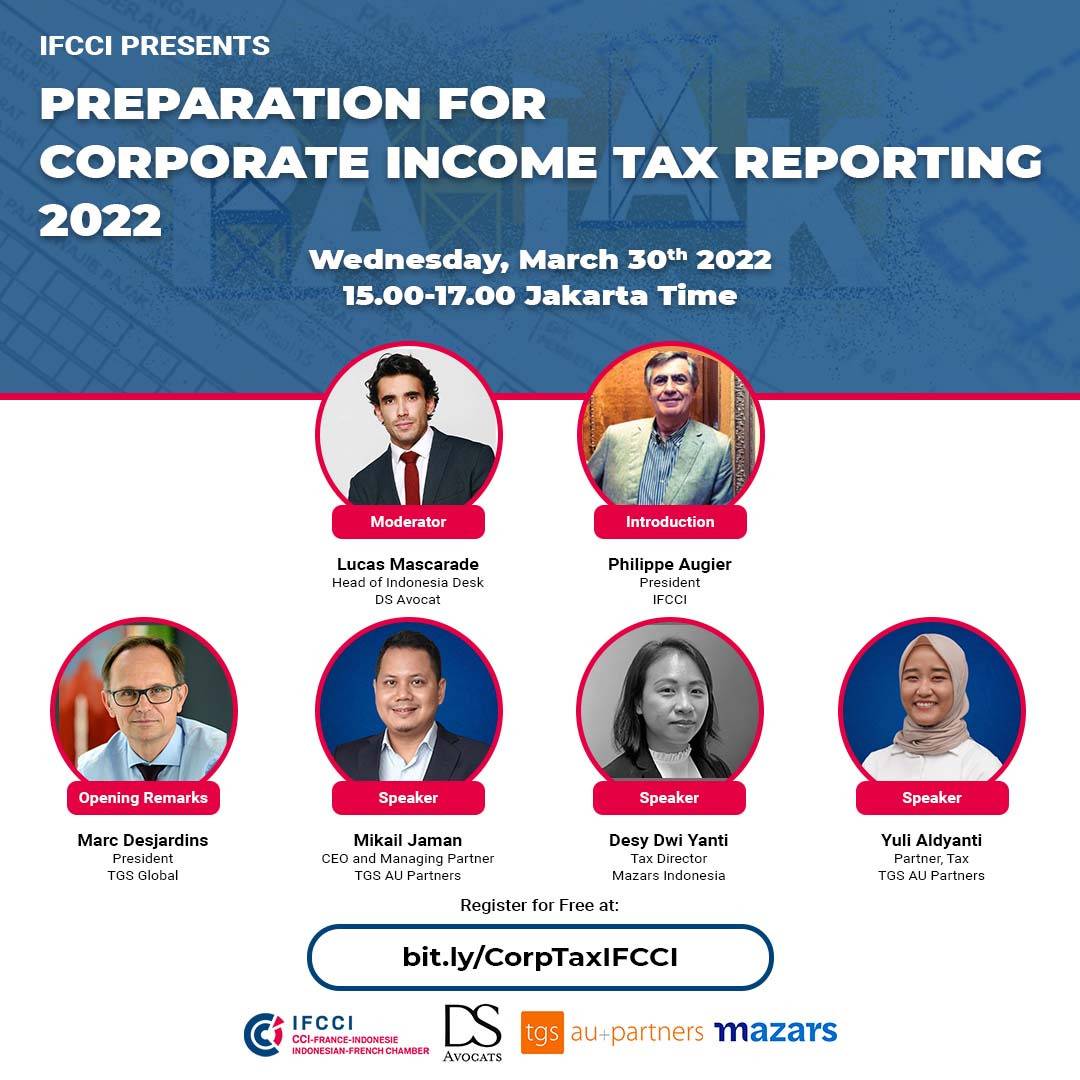

As we are getting closer with 30 April 2022 (latest day to submit corporate income tax report), TGS AU Partners support the Indonesian French Chamber of Commerce and Industry (IFCCI), to host tax webinar Indonesia Corporate Income Tax 2021 Preparation, Important ... Read more