Statement of Financial Accounting Standards (PSAK) 72 and Statement of Financial Accounting (PSAK) 7

With the enactment of Statement of Financial Accounting Standards (PSAK) 72 (Revenue from Customer Contracts) and Statement of Financial Accounting Standards (PSAK) 73 (Leases) for the financial year starting on January 1, 2020, with a quite crucial difference from the previous one, it has the potential to affect the business performance (income and profit) and financial position (assets and liabilities) presented in the financial statements. In order not to lose the opportunity to record revenue or maintain a certain level of profit in financial reporting in a period, it is necessary to pay attention to the provisions that apply to PSAK 72 and 73, including considering adjustments to contracts with customers and leases, business models and also lease schemes.

PSAK 72 was adopted from IFRS 15 to comprehensively regulate revenue recognition to replace several previous PSAK. In PSAK 72, revenue is recognized when the performance obligation is completed. The main points of PSAK 72 include how to recognize revenue when fulfilling performance obligations, significant funding components, contract combinations and modifications, variable fees, transfer of control, and contract costs.

PSAK 73 was adopted from IFRS 16 with the purpose of transparency and comparability to replace the previous PSAK. PSAK 73 records lease and non-lease transactions that impact the lessee's income financial statements. The main points of PSAK 73 are include transfer of control, provisions for sub-lease transactions, variable rental fees, determination of assets (identification), and the concept of financing.

Therefore, with the PSAK 72 and PSAK 73 Case Study Workshops from TGS AU Partners, we hoped that all participants will be able to understand the concept and application of PSAK 72 and 73 in various transactions. Workshop materials include simulation of calculation and recording of transactions according to PSAK 72 and 73.

The workshop is held online with zoom.

Our Service Recommendations

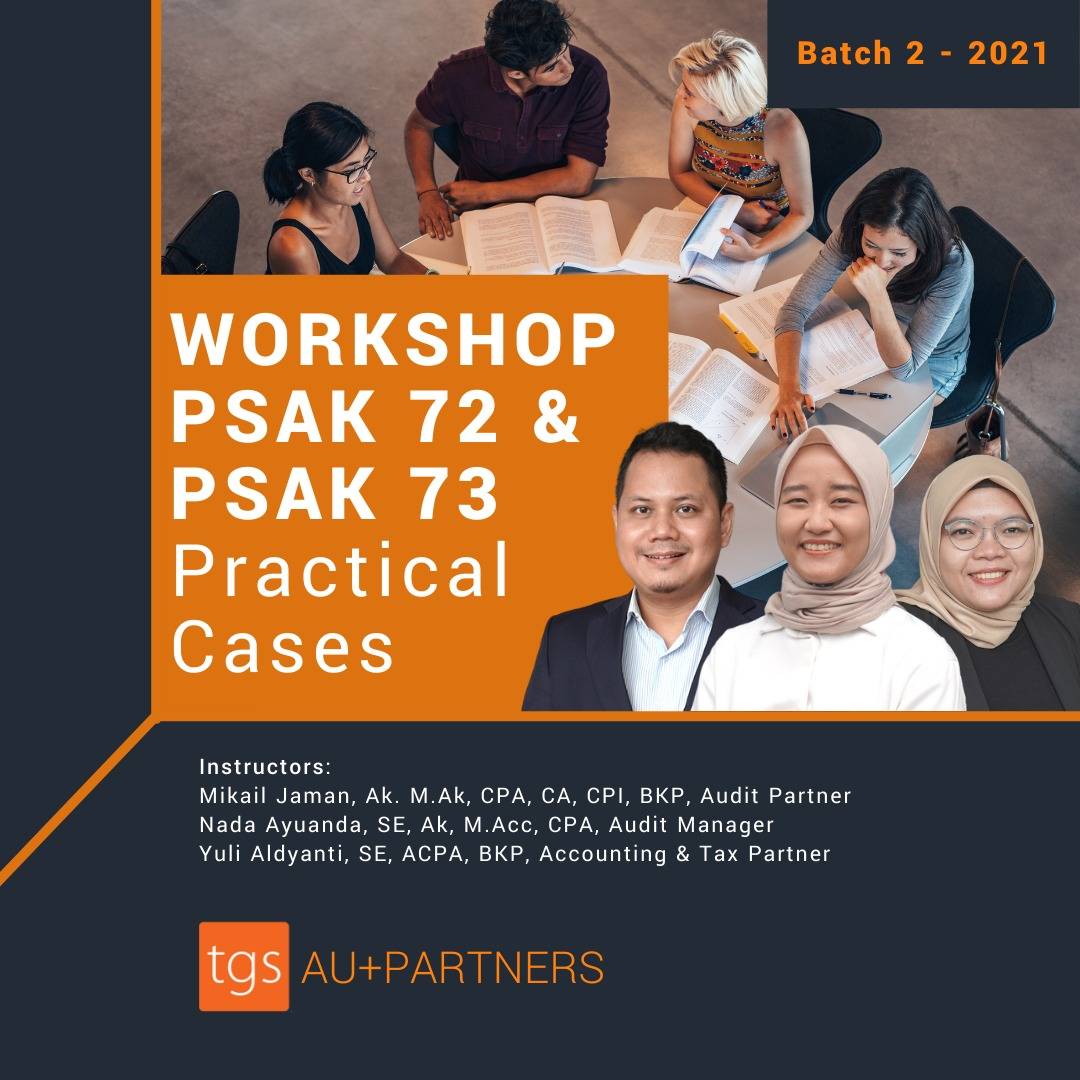

Workshop Instructor:

TGS AU Partner instructor team lead by Mikail Jaman, Ak., M.Ak., CPA., CA., CPI., BKP, Partner at TGS AU Partners

Mikail has more than 13 years of experience in auditing, accounting, and tax. One of his experiences is providing consultation regarding the implementation of PSAK 71, 72, and 73 in various companies since 2019. Mikail has been an instructor for CPSAK and CPA preparation courses at PPA UI and was also involved in preparing CPA Exam questions. He also taught as a lecturer at a private university in Jakarta for auditing and financial accounting courses.

During 2012-2017, Mikail Jam'an was a member of the professional standards implementation committee at the Indonesian Institute of Certified Public Accountants. He is an active member at the Indonesian Institute of Certified Public Accountants, Indonesian Institute of Accountants, Indonesian Institute of Tax Consultant, and International Fiscal Association.

He has been admitted as Public Accountant registered in the Indonesian Financial Authority for Banking and Capital Market sector.

Workshop Schedule:

2,5 hours x 4 meetings (starting at 4th week on July, 03.30 pm-06.00 pm)

News & Articles Recommendations.

The participant will receive:

- Learning Materials (softcopy) including an example of calculation paper sheet

- E-Certificate

Workshop Fee:

The fee for this workshop will be IDR 2.000.000,-

(Early bird fee IDR 1.500.000,- for payment until 06.00 pm on July 10th, 2021

Registration:

https://forms.gle/bnx338Mcqd88QBh97

News & Articles Recommendations.