Coretax Era’s Corporate Income Tax: Key Things Companies Should Be Aware of

As the corporate tax filing season approaches, every financial and fiscal decision made by a company will be increasingly scrutinized—not only by tax auditors, but also by the Coretax system. This digital tax administration platform enables the tax authority to conduct deeper, faster, and more integrated data analysis.

In this environment, preparing a Corporate Income Tax (CIT) Return is no longer a purely administrative task. Even minor inconsistencies in fiscal reconciliation, expense treatment, or data alignment across reports may significantly increase the risk of a tax audit.

How Coretax Changes Corporate Tax Reporting

The implementation of Coretax represents a major shift in Indonesia’s tax administration landscape. With broader data integration and automated validation, the tax authority is now able to:

- Cross-check financial statements against tax filings in real time

- Detect anomalies and inconsistencies at an early stage

Our Service Recommendations

- Map taxpayer risk profiles based on transaction patterns

For companies, this means that corporate tax reporting must be approached strategically—ensuring not only compliance, but also defensibility when reviewed by the system or tax auditors.

Common High-Risk Areas in Corporate Income Tax Reporting

Based on professional practice and audit experience, several areas consistently attract attention during tax reviews, including:

- Inconsistencies between financial and fiscal reconciliation

- Expenses that may be non-deductible for tax purposes

- Differences in revenue recognition between accounting and tax treatment

- Insufficient or poorly prepared supporting documentation

Without a clear understanding of these risk areas, companies may face tax adjustments and penalties—even when they believe their filings are compliant.

Strategies for Building a Low-Risk Corporate Income Tax Return

A safe approach to Corporate Income Tax reporting does not mean being overly conservative. Instead, it requires a risk-based and well-documented strategy. Common best practices applied by professional advisors include:

- Preparing structured and traceable fiscal reconciliations

News & Articles Recommendations.

- Identifying potential risk areas prior to filing

- Aligning accounting policies with their tax implications

- Assessing data readiness in anticipation of possible tax audits

These steps help ensure that the Corporate Income Tax Return is not only compliant, but also robust when subjected to digital and manual examination.

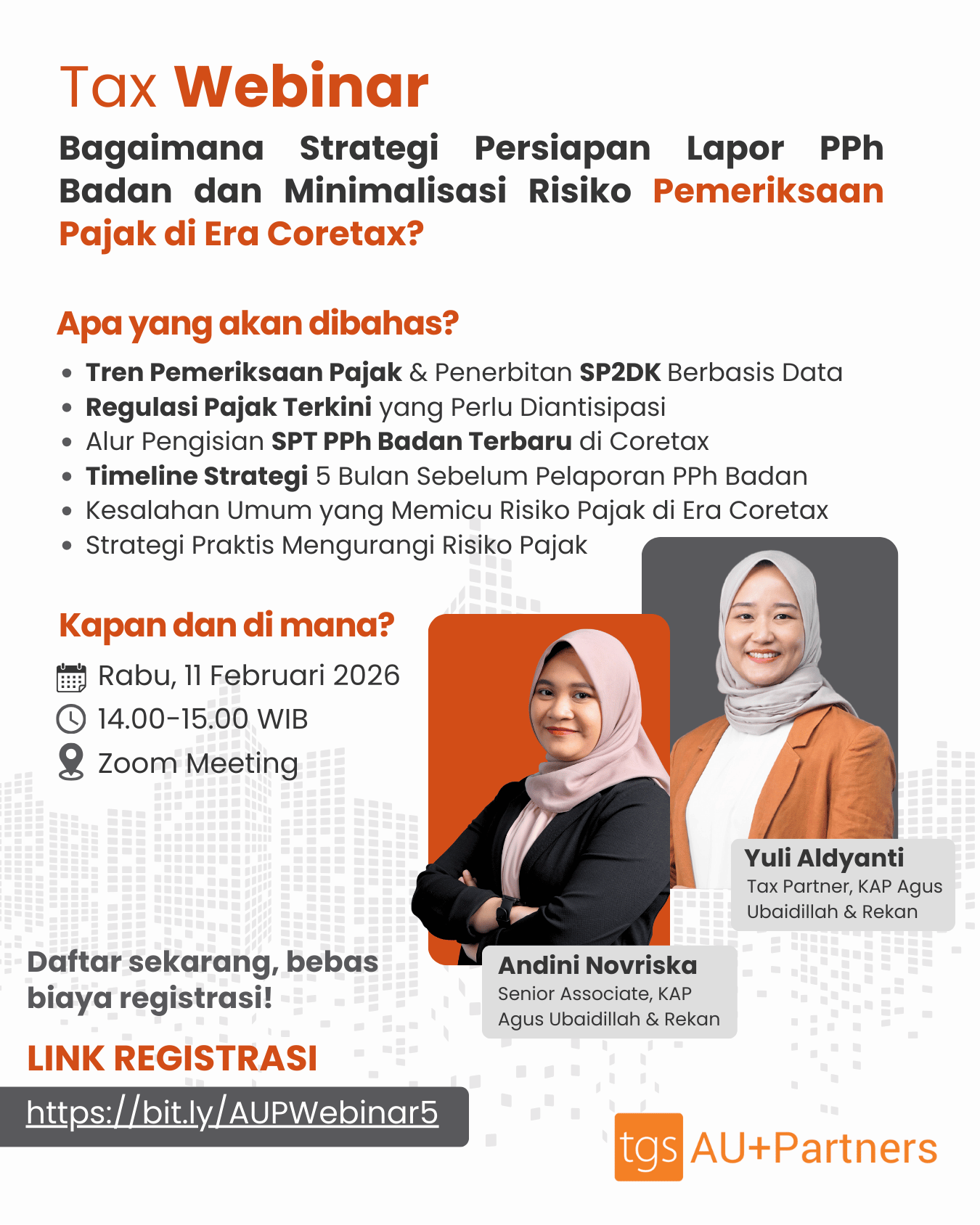

Tax Strategy Webinar 2: Navigating Corporate Tax Reporting in a Digital Era

To support companies in strengthening their Corporate Income Tax reporting, a Tax Strategy Webinar will be conducted, focusing on practical preparation in the Coretax era.

Webinar Details:

- Date: Wednesday, 11 February 2026

- Time: 14.00–15.00 WIB

This session is designed for:

- Company directors and executives

- Finance managers and finance teams

- Business owners seeking to minimize tax audit risk

Led by experienced Tax & Accounting Specialists, the one-hour session will cover financial-to-fiscal reconciliation strategies, identification of audit-prone areas, and practical approaches to building efficient, low-risk tax reports.

With proper preparation and professional guidance, tax audit risks can be minimized without compromising business efficiency.

Register for the Tax Strategy Webinar here: https://bit.ly/AUPWebinar5

Important Notice

This webinar will be conducted fully in Bahasa Indonesia.

The English article is provided for informational and promotional purposes for international readers and stakeholders.

News & Articles Recommendations.